- The Future is Now

- Posts

- Uber's Ride: The Story of the Modern Day Taxi

Uber's Ride: The Story of the Modern Day Taxi

A deep dive into the beginning and growth of Uber, and how you can learn from their success.

Hello future founders! Thank you for tuning in this week. Today, we bring you the story of Uber, the largest ridesharing app in the world.

Uber’s story is a journey of rapid ascent, disruption, and hard lessons. What began as a simple idea to tap a button and get a ride grew into the world’s most valuable startup, reshaping urban transportation. This article takes you through Uber’s journey from its founding in 2009 to its current state, highlighting key milestones, growth strategies, setbacks, and pivots. More than a history, it’s a story rich with lessons on innovation, growth, and the pitfalls of moving fast.

Uber was born on a snowy night in Paris in 2008, when entrepreneurs Garrett Camp and Travis Kalanick couldn’t find a taxi. Camp envisioned a premium “black car” service summoned via mobile app, but Kalanick only agreed to join if they ditched owning any cars and focused purely on a ride-hailing platform. The duo launched UberCab in San Francisco in 2009, initially targeting tech-savvy professionals with a luxury car experience. They cleverly jump-started driver supply by offering free iPhones pre-loaded with the Uber app to limo and town car drivers, who welcomed the chance to earn extra fares during downtime. This asset-light model meant Uber didn’t need to own vehicles or garages – a key to scaling fast.

In July 2010, UberCab’s app facilitated its first ride request in San Francisco, demonstrating the convenience of hailing a ride from a smartphone. Despite charging roughly 1.5 times the price of a traditional cab, early users flocked to the service for its ease and reliability. Success was met with immediate friction: San Francisco transit authorities slapped UberCab with a cease-and-desist, arguing it was an unlicensed taxi operation. In response, the startup rebranded as simply Uber in October 2010 and forged ahead, even as regulators threatened fines and jail time for operating outside of taxi laws. By late 2010, Uber had secured its first $1.25 million in angel funding and named Kalanick as CEO (taking over from first hire Ryan Graves). The founding chapter closed with a viable product, a growing base of drivers and riders, and an early taste of the regulatory hurdles to come.

An billion dollar tweet from Travis looking for Uber co-founders. Yes, this is 100% real.

Uber hit the ground running in 2011, leveraging its Silicon Valley roots and an intense appetite for expansion. The company’s asset-light strategy (no owned cars, just a tech platform) enabled rapid city launches. By mid-2011 Uber was rolling out in New York City, taking on the iconic yellow cabs, and even in Paris, the very place the idea was conceived. That year, Uber also closed two critical funding rounds: a $11 million Series A followed quickly by a $37 million Series B, attracting investors like Goldman Sachs and Amazon’s Jeff Bezos. These cash infusions gave Uber a war chest to expand and subsidize growth. The company poured money into referral programs and free ride credits, an aggressive marketing move that rapidly grew its user base. This tactic ignited strong network effects – more riders attracted more drivers, and more drivers meant faster pickups, drawing in even more riders. Uber’s growing liquidity in each city became a competitive moat.

By 2012, people were hailing Ubers in cities across the U.S. and Europe. That year also marked Uber’s first major pivot: facing new competition from Lyft (which offered everyday cars driven by regular people), Uber expanded beyond luxury cars. In mid-2012 it launched UberX, a lower-cost service that allowed ordinary drivers with their personal vehicles to offer rides. This move dramatically broadened Uber’s market – suddenly ridesharing wasn’t just a high-end limo service, but a convenient option for the masses. UberX would soon become the company’s most popular offering. The effect on growth was explosive. By 2013, Uber was operating in 40+ countries, including major markets in Europe, India, and even China. Its valuation leapt to about $3.5 billion by mid-2013, a stunning rise for a four-year-old company. However, early cracks were forming in the model: that year, Uber drivers in California filed a class-action lawsuit seeking to be treated as employees rather than contractors – foreshadowing a long battle over the gig economy’s labor practices.

2017 would prove to be Uber’s toughest year – a crucible of controversies that nearly derailed the company. It began with a public relations fiasco in January. When New York taxi drivers staged a strike to protest U.S. immigration policies, Uber announced it would suspend surge pricing at JFK airport. This move was interpreted by many as Uber undermining the strike for its own gain, sparking the viral #DeleteUber campaign . Within days, over 500,000 users deleted the app in protest. CEO Travis Kalanick, who had joined an economic advisory council for the new U.S. president, faced intense backlash and resigned from the advisory role under pressure. The incident was a stark lesson in how quickly public sentiment could turn on a tech darling and showed the risks of perceived opportunism in a politically charged moment.

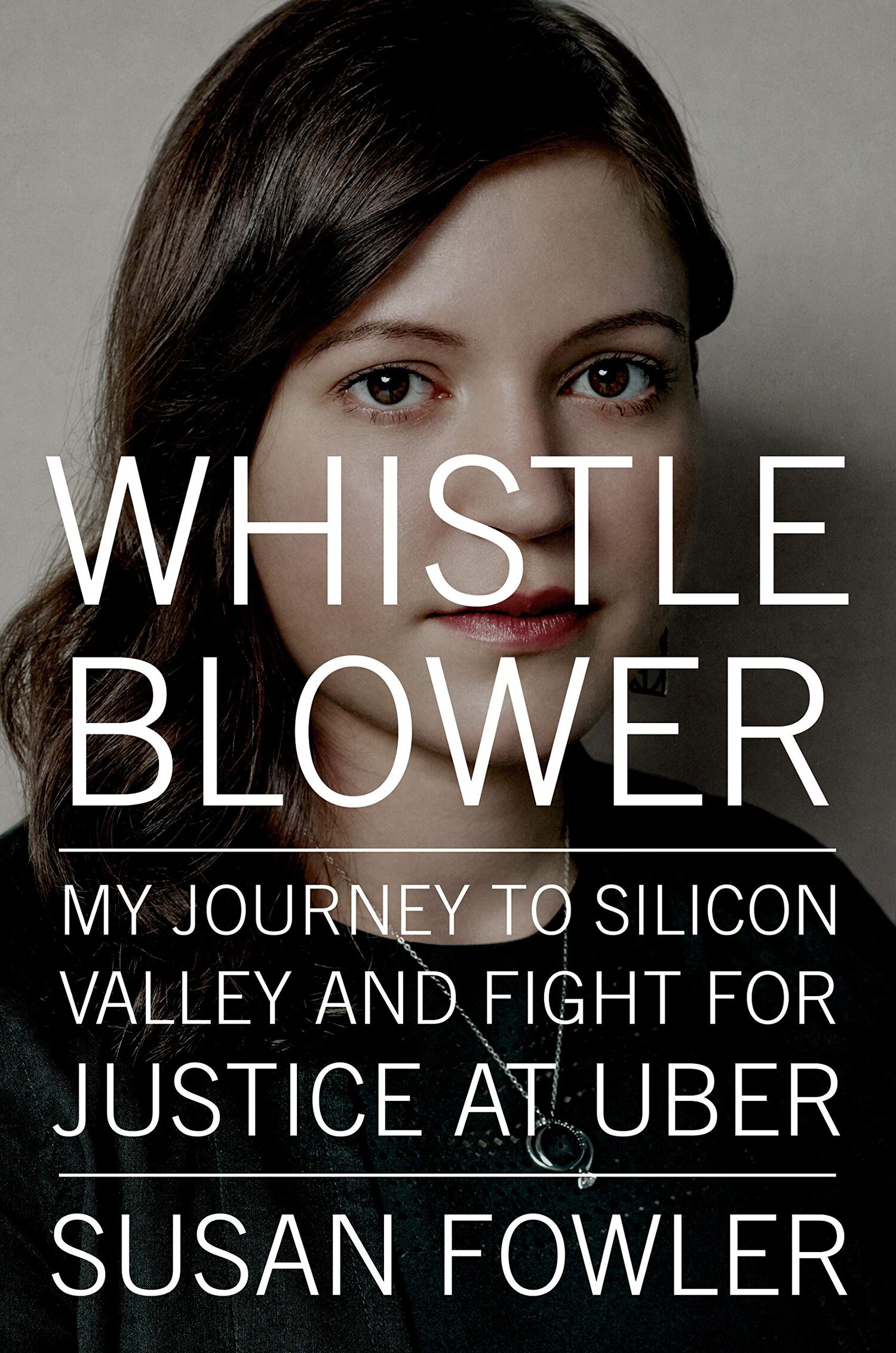

Then in February 2017 came a bombshell that rocked the company’s culture. Susan Fowler, a former Uber engineer, published a blog post describing systemic sexism and harassment within Uber’s workplace. Her detailed account of ignored complaints and a toxic culture went viral, prompting Uber to hire former U.S. Attorney General Eric Holder to investigate the company’s practices. The ensuing probe led to 20 firings and 47 recommended reforms, validating that Uber’s rapid growth had outpaced its management maturity. As if that wasn’t enough, in March 2017 The New York Times exposed Uber’s secret “Greyball” software program, which the company had used to evade regulators in cities where its service was restricted. Greyball identified officials and served them a fake version of the app to prevent stings – a crafty growth hack that, once revealed, drew widespread condemnation for Uber’s brazen disregard of the law.

All these issues culminated in a full-blown leadership crisis. Uber’s investors and board, alarmed by the company’s tarnished reputation, pressured Travis Kalanick to step down. In June 2017, Kalanick resigned as CEO, a stunning fall for the founder who had personified Uber’s aggressive ethos. Uber’s losses that year underscored the turmoil – the company lost a staggering $4.5 billion in 2017. In August, Uber’s board tapped Dara Khosrowshahi, the respected CEO of Expedia, to take the helm and clean up the mess. His mandate was clear: repair Uber’s image, instill a healthier culture, and steer the company toward sustainable growth. The chaotic events of 2017 demonstrated how culture and ethics are as crucial to a startup’s success as growth metrics. For Uber, it was a painful reboot, but one necessary to ensure the company’s long-term survival.

Under Dara Khosrowshahi’s leadership, Uber entered a phase of reflection, repair, and preparation for life as a public company. Khosrowshahi moved quickly to resolve outstanding disputes and slim down the empire to core businesses. In early 2018, Uber settled the high-profile trade-secret lawsuit with Google’s Waymo, paying out $245 million to put the issue to rest. It also continued a strategy of retrenchment from unprofitable overseas battles: Uber sold its Southeast Asia operations to Grab in March 2018 in exchange for a stake, mirroring the earlier China exit. These moves signaled a new pragmatism, Uber would no longer chase growth at any cost, especially where homegrown competitors dominated. The company doubled down on its two main services, rides and food delivery, setting the stage for an IPO. In May 2018, Uber announced it had facilitated 10 billion trips in its history, an astonishing figure that was more than double the total just one year prior. Despite the past turmoil, demand for Uber’s services continued to grow.

In 2019, Uber finally went public – one of the most anticipated tech IPOs in years. On May 10, 2019, Uber rang the opening bell of the New York Stock Exchange, debuting at an initial price of $45 per share and an ~$82 billion valuation. The event was meant to be a triumphant milestone, but reality hit hard: Uber’s stock closed down 7.6% on its first day, making it the worst first-day dollar loss in U.S. IPO history. Investor appetite was dampened by concerns over Uber’s steep losses and path to profitability. In the quarter of the IPO, Uber reported a jaw-dropping $5.2 billion loss. Over the following months, the stock slid further, ending 2019 about a third below its IPO price. Even Travis Kalanick seized the moment to cash out – he sold over $2.5 billion in shares and cut his remaining ties with the company by year’s end. One investor famously described the post-IPO situation as a “horror show,” as Uber’s public market debut failed to live up to its private market hype. In response, Khosrowshahi undertook cost-cutting measures, including layoffs of over 1,000 employees, to assure investors that Uber was on a track to eventually make money. The sobering IPO experience taught Uber a lesson that skyrocketing growth and generous venture capital subsidies would need to give way to disciplined operations and clear financial metrics in the public markets.

By 2023, Uber’s long quest for profitability finally hit a milestone. After racking up nearly $30 billion in operating losses from 2016 through 2022, Uber reported its first-ever annual profit as a public company in 2023, with net income of $1.89 billion. This profitable turn, five years post-IPO, validated the persistence of Uber’s model – proving that with sufficient scale, network effects, and operational efficiencies, the unit economics could work. Investors responded positively, and Uber’s stock nearly doubled from its 2019 IPO closing price by early 2025. The company even initiated a $7 billion share buyback in 2024, signaling confidence in its future. Uber now sits as a dominant player in its core markets; in the U.S., it grew its ride-share market share from about 70% to 76% during 2024, leaving arch-rival Lyft far behind. Globally, Uber operates in over 70 countries, though notably it remains absent or banned in some regions that resisted ride-sharing disruption. With a market capitalization hovering around $160 billion and annual revenues over $40 billion, Uber has solidified its place as a transportation and logistics powerhouse.

The Uber of today is a far cry from the free-wheeling startup of a decade ago. The culture has been overhauled as Uber promotes itself as a more humble, responsible company, focused on “doing the right thing” and treating drivers as partners. Dara Khosrowshahi remains at the helm, emphasizing sustainable growth and compliance with local laws, a strategic shift from Uber’s early “ask forgiveness, not permission” mantra. The company continues to innovate at the edges – piloting partnerships for autonomous vehicles (recently teaming up with Waymo to offer driverless rides in select cities), and expanding Uber Eats into a broader “Uber Everything” delivery platform for groceries, packages, and more. The past challenges have made Uber more disciplined, but the ambition is still very much alive. As Uber drives further into its second decade, it faces new tests: competition from gig economy players in delivery, regulatory debates over gig worker status, and the need to maintain growth without sacrificing profitability. Yet, having survived the storms of its own making, Uber rides into the future with hard-won experience and momentum on its side.

Leverage network effects and scale fast: Uber showed the power of network effects in a two-sided marketplace. By aggressively subsidizing early growth (e.g. free ride credits and driver bonuses), it built liquidity that competitors struggled to match. Once riders expect an Uber to be minutes away everywhere, and drivers know riders are plentiful, the platform becomes self-reinforcing. For founders, if your model has network effects, speed of expansion can be critical to lock in a leadership position.

“Ask forgiveness, not permission” – but know the risks: Uber famously expanded by flouting or lobbying against outdated regulations, from taxi licensing rules to labor classifications. This created explosive growth, but also sparked legal battles and reputation hits. The lesson is that disruptive startups must often challenge status quo regulations, but there’s a fine line between bold and reckless. Engaging with policymakers early or self-regulating can mitigate backlash that might otherwise stall your business.

Culture and leadership matter at scale: Uber’s early “win at all costs” culture, driven from the top, contributed to serious internal problems and public backlash. A toxic culture can erode even the most successful business. Investing in a positive, inclusive culture and strong ethical leadership is not optional – it’s a core strategy for long-term sustainability. Travis Kalanick’s ouster and Dara Khosrowshahi’s rehabilitation of Uber underscore how essential good governance is to a company’s health.

Regulatory foresight is a strategic advantage: Nearly every market Uber entered required navigating local laws (transport rules, labor laws, etc.). In many cases Uber acted first and negotiated later. While this created a first-mover advantage, it also incurred legal costs and sometimes forced exits (e.g. China). A savvy approach is to combine innovation with advocacy – helping shape regulations that allow new models to thrive. Companies that can work with regulators (or at least not constantly against them) may find more durable success.

Uber’s rise from scrappy startup to global giant illustrates both the opportunities and perils of aggressive entrepreneurship. Aspiring founders can draw inspiration from Uber’s boldness, its willingness to reimagine an industry and grow at warp speed, while also heeding the cautions of its stumbles in management and compliance. The road to success will have bumps and detours, but as Uber has shown, resilience and adaptation can steer a company back on course.Uber’s wild ride offers a roadmap of hard-earned lessons for those daring enough to disrupt the next industry.

Hey! Thanks for tuning in this Monday, and here is part 8 of our startup spotlight segment. This week’s spotlight is…. Shield AI!

Shield AI is a pioneering deep-tech company founded in 2015, specializing in AI-powered autonomy solutions for defense and aviation. Its flagship product, Hivemind, enables drones and aircraft to operate autonomously in GPS- and communication-denied environments, making it a game-changer for military operations. Shield AI's technology allows for real-time decision-making and adaptability, enhancing situational awareness and mission success rates.

What makes Shield AI cool? It's at the forefront of AI innovation, providing combat-proven solutions that have been deployed by U.S. and allied forces. Its commitment to advancing autonomy technology is revolutionizing the defense industry, making it safer and more efficient. With recent funding of $240 million, Shield AI is poised to further scale its impact globally.

Thank you for tuning in this week! Your consistent engagement is what makes this newsletter possible. If you are interested in reading more of our articles feel free to click below to explore more of our articles.

I would suggest to check out, if you haven’t already, our article about OpenAI to learn more about the company and app that has become an integral part of many people’s lives. Also to learn a little more about the Elon Musk and Sam Altman beef 🤣. Thanks again for tuning in, see you on Friday :)